Open Banking: Next Major Digitisation Narrative After FinTech

Open banking is on the rise in Europe. Between upcoming regulatory changes—most notably the implementation of PSD2 (the revised Payment Services Directive)—and increasing customer demand for technologically enabled services, the retail banking and payments sectors in Europe must grapple with a fast-evolving landscape. The notion of open banking has been central to financial services dialogue for many months, fueled in part by the buildup to the EU’s revised Payment Services Directive. Open banking is a model based on banking data sharing between two or more unaffiliated parties to deliver enhanced capabilities to the marketplace.

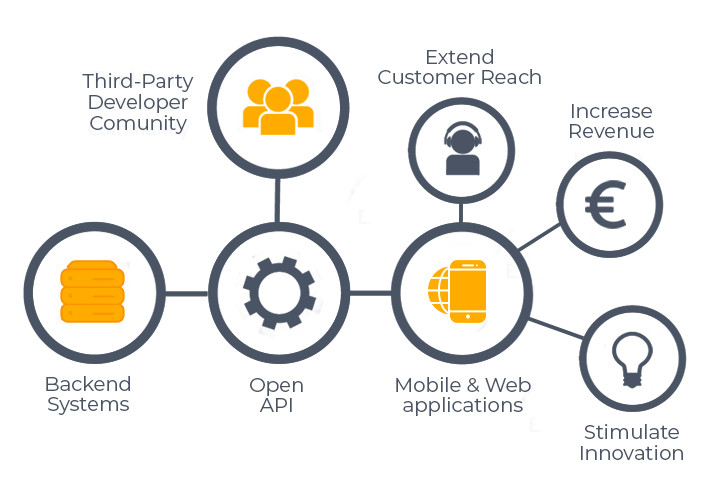

Until recently, a consumer’s financial data was centrally held within their financial institution. But it has started to change with the implementation of various Open Banking initiatives that have evolved over the past decade and launched within recent years across the globe. It has become apparent that the future of banking will be driven by open business models and APIs.

Since the Open Banking Implementation Entity (OBIE) has rolled out two of the four releases as part of its roadmap, over 20 million API calls for data are being made every month. Recently the greatest beneficiaries of account switching have been banks like HSBC, Santander, and Nationwide, along with FinTechs like Monzo, Starling, and Revolut.

In the US, though regulatory changes are likely far off, it is inevitable that a more open model will emerge as big tech players like Google, Apple, Amazon, and Facebook dabble in payments and other activities, as in the case of Apple’s new Apple Card initiative, in partnership with Goldman Sachs.

While it might not be as avant-garde as some bank-insiders would like, Apple is putting its stamp on the payment space by declaring: “Created by Apple, not a bank” in its launch campaign. Much to banker’s chagrin, this will likely resonate with consumers more than they’d like.

Meanwhile, the emergence of super app models in the East by tech giants such as Alibaba and Tencent has presented consumers with a new way of consumer banking services, most notably in the payments area. Challenger banks such as MYbank and WeBank (backed by Alibaba and Tencent respectively) have grown substantially the past few years. At the same time, Alibaba’s affiliate Ant Financial has been expanding rapidly outside of its home market, China, by pursuing a strategy of serving the enormous market of Chinese tourists and are accustomed to the AliPay platform. The super app is connected with more than 200 institutions, including over 100 banks, 60 insurers, and 40 wealth management companies and security brokerages.

It is still far too early to judge whether the great unbundling efforts have been successful or not. Thousands of FinTech startups have taken market share in key revenue areas and banks partnering and investing in them has not slowed down the march and impact of the FinTech ecosystem. The move toward Open Banking and large-scale efforts by dominant technology platforms will only exacerbate the issues banks face. Technology will continue to enable new value propositions that were never expected. This will work to re-establish customer intimacy and trust by acting as a personal CFO for customers across every walk of life. Winners will be those that can create longer-term savings and wealth, optimize spending, and build more proactive and personalized insights that extend beyond traditional financial services. Re-bundling acts as an opportunity for us to re-imagine – not to build on the past, but to seed future business models. In a world where Chinese citizens with Chinese bank accounts can conduct their whole life on Alipay and WeChat super apps while outsiders pay cash; where 47% of American consumers are still writing checks; where people in Africa can pay and obtain microloans on their mobile phones in an instant – the answer to the age-old question to the promised land: “Are we there yet?” is, unfortunately, “No, not yet.” As Chris Skinner wrote in his book Digital Human: “The new world is one of the transient relationships, shorter-term commitments, and everything online all the time. However, the financial system is built for lifetime relationships, long-term engagement, and everything over the counter.” If the industry is to thrive in a new environment with competition from global technology firms, we must leverage the scale and trust of incumbent banks, agility, and focus of FinTech startups. It is time to embrace open banking business models or banks will cease to exist.

No one knows for sure how open banking will evolve and trying to predict exactly what will happen is almost impossible. Nevertheless based on experience ATKearney envision a variety of potential end states. Four scenarios reveal how the European Union market could shift. Armed with this scenario-based view of the future of open banking, organizations can explore the potential options and develop a playbook for each scenario. While some scenarios will never come to pass or develop to the extremes discussed here, each one can be used to identify “no-regrets” actions along with the actions that are worth taking with a wait-and-see approach. These scenarios also allow tracking a small number of metrics that will indicate the market’s direction of travel and the potential end state.

In the first scenario, The Rise of the Giants, the largest digital companies have pushed into retail banking across Europe and are competing in significant sections of the value chain. These technology titans are expanding into retail banking by capitalizing on their scale in terms of both customer reach and customer proximity, often owning the “last mile” to consumers. These companies exploit their digital expertise, customer-centric culture, and focus on the user experience to make compelling customer experiences with a low-cost base, enabled and designed from the ground up using cutting-edge technology. Although these digital giants may not actually operate a banking balance sheet, they will compete to displace incumbent retail banks and other providers from any customer-facing activities and—where possible— relegate them to a pure utility or balance-sheet role. The commercial impact on retail banks could be significant as the interest income is reduced through lower-friction switching and the cost of acquisition increases in the battle to attract new volume through large platform providers. It is difficult to see how a retail bank could compete in this scenario, beyond trying to build very local solutions tailored to a specific market, which the global digital players would be unwilling or unable to compete with. The exact nature of these local solutions remains to be seen. This scenario could be the most challenging for retail banks. In fact, because of the economies of scale and reach, only the largest is likely to survive.

In the second scenario, Status Quo, open banking has a much more limited impact on the market, and consumers’ uptake is also limited. Because open banking relies on consumers’ adoption, failing to attract new customers would be a major obstacle. For example, in the United Kingdom, current account switching has not yet overcome the challenge of consumers think it is simply too difficult. Open banking could face the same challenge—likely because third-party value propositions may not be compelling enough to entice users beyond niche levels. In this scenario, a few small propositions will come to the market, but they won’t see widespread adoption. There may be specific cases where there is substantial adoption, such as streamlined customer onboarding and know your customer, but the overall size and shape of the value pools for retail banking and for payments will remain unaffected. Nevertheless, this scenario is unlikely because of the regulatory pressure, investment, and progress made in this space.

The third scenario, Banking Dominance, tackles the idea of value-chain disruption but suggests that the largest banks would be the likely winners as they capture the value and fortify their ecosystem. In this scenario, the largest retail banks use open banking and PSD2 to recapture value from net interest margin compression and loss of interchange through new products and services that their competitors cannot match. They build their own payment networks and integrate directly with the largest merchants, and they compete by capitalizing on customers’ trust and developing digital-ready products and services. However, not all banks are so lucky. The small and medium-size banks are unable to compete in either customer experience or pricing—driven by operational excellence and the cost-of-funds benefit from scale. The result is a significantly consolidated market. A lack of investment will widen the gap between new mid-tier banks and large banks and FinTechs. In fact, forward-thinking companies are already setting themselves up for success by investing in this space beyond the regulatory requirements.

In the fourth scenario, the Retail Revolution, merchants use open banking to facilitate seamless purchases—using either a credit or a non-credit model. Retail banking is no longer separated from retailers but is fully integrated for most purchase types. In this world, merchants use loyalty schemes and targeted marketing to increase sales, boost margins, and improve performance—all fully integrated with financial products and services. Retail banks still own the secured lending product, but all other transactional banking and lending products are facilitated at the point of sale. In this scenario, there is a significant impact on all non-secured lending products in terms of both customer acquisition and overall profitability. Only the largest retail banks will invest heavily in this to capture the value on the table. The rest will likely rely on their acquirers to capture and share some of this value.

Over the coming few years, we expect to see a rapid uptake of open banking approaches and models as people become more aware of the benefits it could bring consumers and small to medium enterprises (SMEs) – the ability to quickly understand their financial position, explore alternatives and make better financial decisions. Catalyzed by regulation, banks in Europe, the UK and Australia are already hard at work testing and prototyping new use cases and operating models that leverage application program interfaces (APIs) and open banking principles, such as comparison services, know-your-customer, auto savings, and credit scoring to name a few. As these use cases are commercialized into functional solutions, the lure of open banking will grow (both for banks and for consumers). At the same time, we expect to see customer demand and shifting expectations drive increased adoption of open banking models, even where regulation doesn't explicitly require it. Customers are looking for easier, more seamless and intuitive value-added banking experiences and there are a growing number of FinTechs and 'challenger banks' seeking to capitalize on these developments. As these new offerings start to influence customer expectations – and as customers start to understand and assess the value of their data – many banks will have little choice but to shift towards more open models (if only to reduce the friction between ecosystem partners) as they strive to offer better customer experiences.

The innovation potential of Open Banking does not stop here. Unprecedented levels of collaboration between banks and FinTech providers highlight the mutual benefits of combining a bank’s scale, large customer base and economic muscle with the fast-moving and innovative skills of smaller FinTech firms. Innovations underway include apps to help consumers find the best investment or borrowing offers in the market and tools for businesses to manage their cash more efficiently or forecast working capital requirements more effectively. And this is just the start. The competition will intensify with new entrants, offering innovative value propositions and new business models. Other markets are also directing an API-driven open banking agenda. In Europe, the revised Payment Services Directive, PSD2, came into effect from September 2019. Australia introduced Open Banking in June 2019 for the country’s Big Four banks. The Hong Kong Monetary Authority has announced an Open API Framework which paves the way for banks to share data with third-party providers. Similarly, Canadian authorities are exploring the introduction of Open Banking soon after the launch of its Real-Time Rails program. The Monetary Authority of Singapore is also encouraging banks to adopt a voluntary transition to Open Banking. And in the US, a number of the large banks already voluntarily offer open APIs to third parties, pre-empting the regulators by using APIs as a competitive advantage, rather than mere compliance with a mandatory change. We are seeing the early stages of a seismic industry migration that will come into full force over the next five years. The emergence of innovations with the potential to drive simplicity and increase flexibility are turning a once complex web of financial institutions into unified tools to maximize value creation.