FinTech Dilemma: Customer Lifetime Value

One of the common disbeliefs is that new customers are the main criteria for business success, but unfortunately, they aren't enough. One of the most overlooked metrics in the pitch decks for young FinTech companies is customer lifetime value. In many cases, companies are fully concentrated on new customer acquisition metrics. However, with increasing competition levels in many markets and the rising costs of new customer acquisition, the focus is shifting to the company's abilities to sustain customer retention. There is a variety of options startups can take to improve customer retaining — for ex., introducing more favorable terms or new products — but an important part of it will be improving the customer experience for underserved customers.

FinTech in Search for Competitive Advantage

Finance relies heavily on technology. But with most financial institutions and tech companies following suit on similar trends, innovation is not enough. And if companies hold an interest in stabilizing their competitive edge, they’ll need to succeed in must-need and sometimes failed areas. The financial industry is experiencing unprecedented disruption, with FinTech companies leading the charge. Today, more than a quarter of Millennials have never visited a physical branch of their bank, and 39 percent would consider going entirely digital. Unencumbered by the legacy systems of big financial institutions, FinTech upstarts introduced the idea that banking should be self-serve, mobile, and 24/7. Now, as FinTech companies are coming into their own, big banks are following their lead. To survive the disruption that they initiated, however, FinTech startups must find a competitive advantage to stand out in a digital world. The increased competition, regulatory hurdles, and high costs of customer acquisition mean we’re going to see rapid consolidation in the space. Large financial institutions need to build or buy innovation to maintain and extend their leadership positions. As consumers demand new technologies, we will see increased adoption or acquisition of FinTech by banks to serve consumers. Besides, the FinTech revolution is expanding the market, thereby positioning some pure-play FinTech startups to become large financial institutions of the future.

The True Cost of Customer Acquisition

It seems like every day you hear of a new FinTech startup entering the market with a better mousetrap. New technologies from Google and Facebook have allowed disruptors to reach customers directly, blockchain has created new ways to underwrite contracts, and emerging mobile and data techniques are changing the way companies can deliver financial services quickly and at a lower cost to the consumer. Their ability to strike where it matters has allowed them to exploit chinks in the armor of large traditional financial services companies. The challenge for all FinTech disruptors trying to grow profitably - they must be surgically precise about the profile of financial customers they are looking to acquire because:

- Large incumbent banks have had the luxury of being less specific with their customer acquisition strategy because they offer a full line of services (they can bring everyone in and offer something of value)

- Copying a large bank’s broad go-to-market will lead to Fintech disruptors depleting their limited growth budgets, while quickly finding out that they can’t service many of those customers profitably.

- Making a hard problem harder is U.S. financial marketing compliance.

- U.S. Fair Lending regulations restrict targeting consumers by many of the dimensions that can signal customer value to a Fintech disruptor. With this constraint, many Fintech companies are quickly forced down a path where they find themselves in a crowded acquisition market with not one, but two or three large incumbents with little room to maneuver.

- Fintech disruptors have much less room for error when it comes to acquiring customers.

- Large banks have a large balance sheet and an already established portfolio of customers to lean on, so they are insulated from customer acquisition investments gone bad. A FinTech disruptor has less margin for error as a bad bet can submarine their growth.

- The margin for error continues to erode.

- Cost per clicks (CPC) continues to rise year over year as the competition for growth continues to increase with both traditional FinServ and FinTech companies going after the same fixed pools of interest.

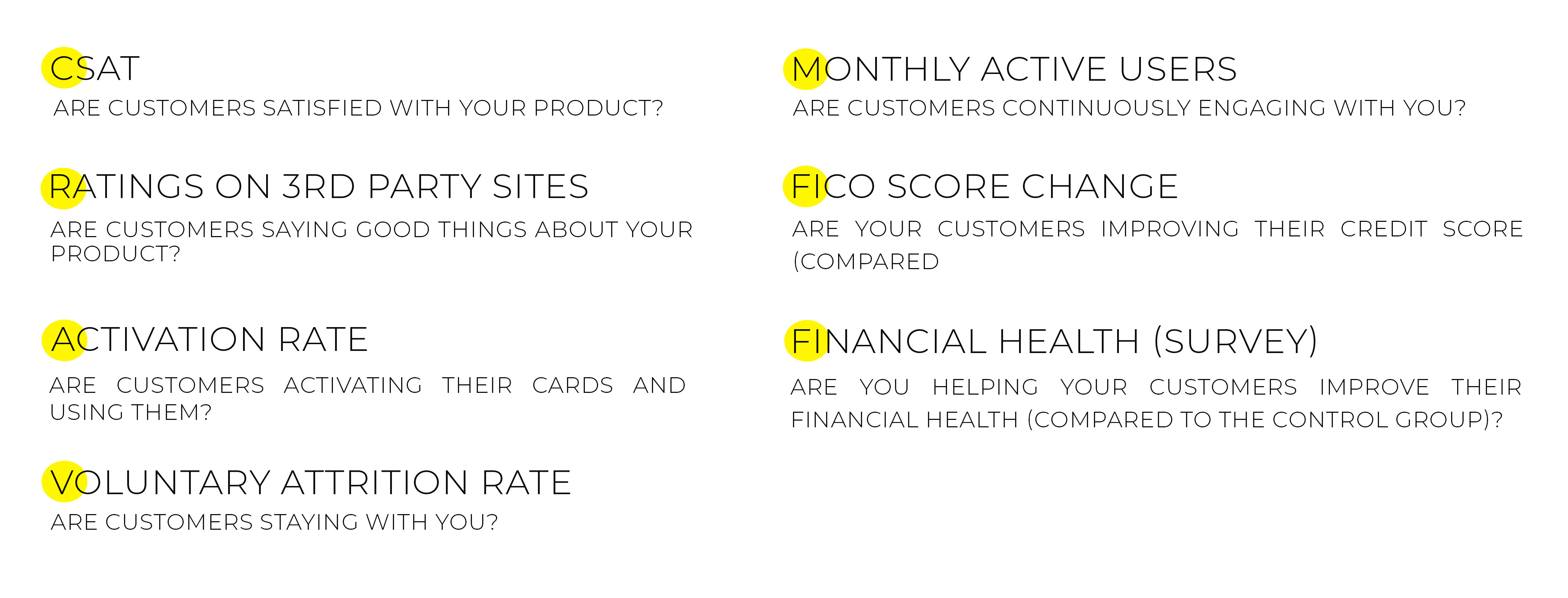

Customer metrics tracked are meant to determine if customers like your product and are better off by using it. In many industries, healthy customer engagement is a significant driver of valuation. Here are a few metrics to measure customer health:

The Importance of Customer Retention

Clever use of digital tools has given FinTech companies the upper hand in terms of customer experience. Mobile apps and cloud-based platforms make financial products and services easier to manage across multiple channels – to the customer’s advantage. One of technology’s most significant contributions is its transparency. Intuitive mobile apps and user-friendly online platforms allow FinTech customers to engage directly with their finances, helping them feel far more in control of their transactions and confident in their decisions. Monzo, a start-up challenger bank, offers a pre-paid card that links to an app on their customers’ phones to give them a real-time overview of all their payments. This kind of real-time log wouldn’t be possible with a legacy bank that doesn’t update the ledger for several days. Financial data can also be presented to customers in a clear, actionable format that helps enhance their understanding. The success of FinTechs, such as cloud software company Xero, whose tagline is ‘beautiful accounting software,’ proves that appearance matters. Customers increasingly expect slick design and seamless user experience, the absence of which can damage credibility. Customer service is, like technology, continually evolving. The agility of FinTech companies gives them a clear, competitive edge over more ponderous banks. However, there is still time for older institutions to shake off their complacency and learn from these dynamic disruptors. Collaboration between banks and established FinTechs is also on the rise, providing banks with greater access to new customers. As the market shifts, FinTech companies move with it. They are continually listening and responding to their individual customers’ needs – and making sure that the products and services they offer are what people want – and need.

Customer Divestment as a Strategical Choice

Not all customers are worth retaining. Some customers are wrong for some businesses. Some start wrong. And for many reasons, some become wrong. Regardless of its genesis, almost every company has a population of wrong customers. Some large. Some small. Divesting them is as natural and essential for businesses as breathing is for humans. Every company should have a plan and process for it. Understandably, customer divestment as a strategic imperative got subsumed in customer-retention hype.

A Plan for Customers Dynamics

A portion of customer churn is inevitable and needs not to be lamented and just planned for. I call this baseline churn. This segment includes companies that go out of business, merge, decide to discontinue or consolidate operations. Customers change their strategies and no longer require a vendor’s product or service. Customers that move from the service area, including offshore. Any of these situations cause churn and none result from a vendor deficiency or customer grievance.

Customers That Are Not a Good Fit Anymore

Churn is essential for financial health. I call this vendor-initiated churn or account divestment. It’s as integral to revenue strategy as account acquisition, maintenance, growth, and win-back. With rare exceptions, endeavoring to hold all your accounts into perpetuity is a mistake. If you are not regularly asking, “Which customers are we better off without?” you risk becoming bloated with statements that don’t fit your business model. High-cost ones, and low-profit. Ones that perennially distract your staff from supporting more valuable opportunities. “Our churn numbers have never been lower! Too bad, our profits are in the tank!” A possible symptom of account bloat. One that the retain-no-matter-what zealots should know quite well. My advice is different from theirs: instead of hemorrhaging cash attempting to satisfy customers that will no longer ever bring you joy, consider letting your competitors serve them. And if you play your cards right, those jettisoned customers will then bring down their profits.

Improving Customer Experience in FinTech Sector

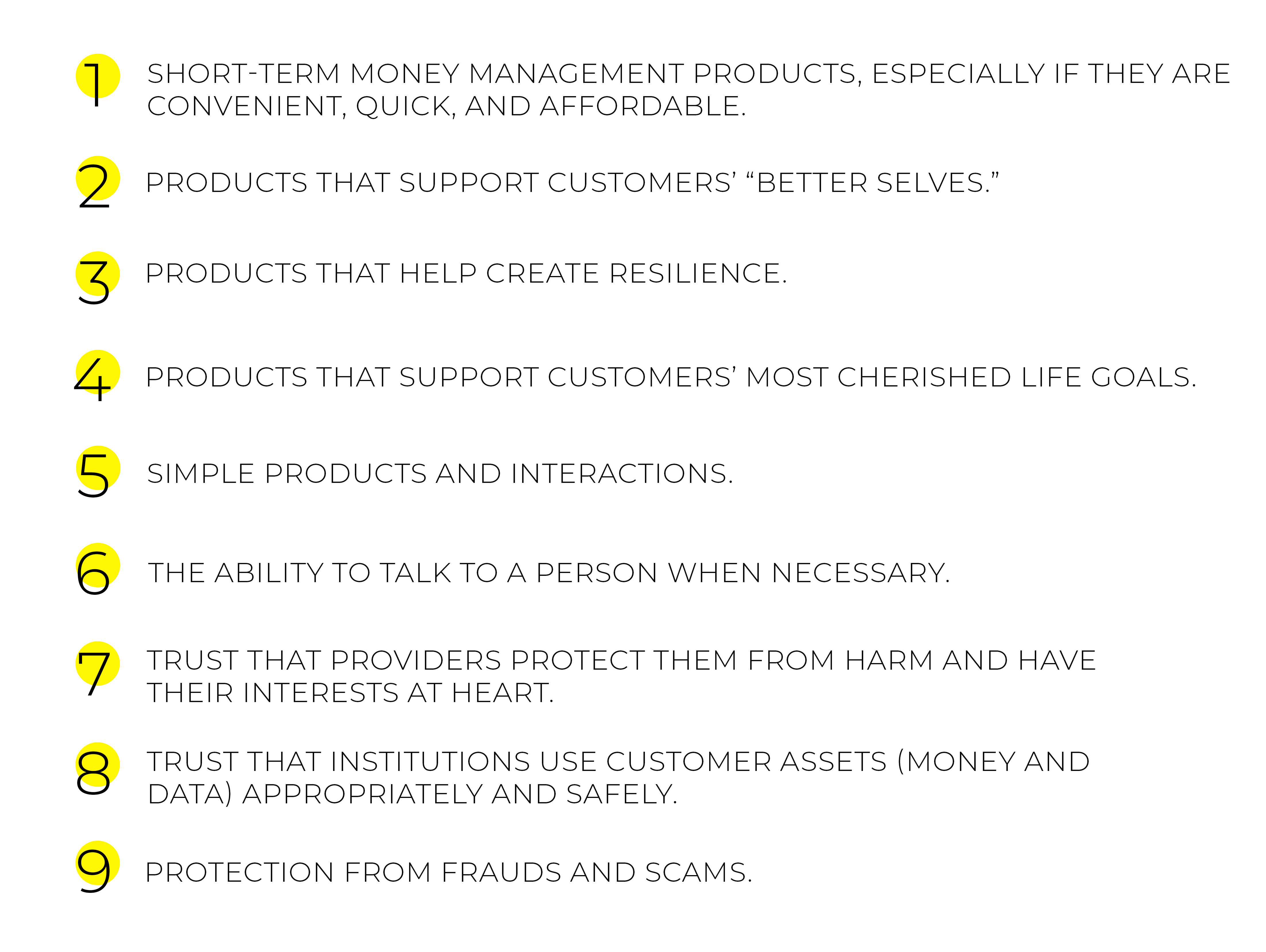

Imagine that low and moderate-income consumers created the financial services of their dreams. How would they describe what they want from their financial services? Would the description resemble the services they receive? Customer wishes are pretty simple, whether customers are poor or not, and whether they live in the frontier, emerging, or high-income markets. First, they want services that help them accomplish goals and solve problems. Second, when they use those services, they want a positive experience. When consumers speak about financial service experiences, they use words like confidence, safety, trust, and understanding – or their opposite: confusion, doubt, and stress. These words convey the severe emotional stakes involved in money matters. By contrast, financial service providers tend to use bloodless jargon like “addressable market,” “customer acquisition,” or “user interface.” Providers must turn these business concepts into a customer experience that evokes confidence and affirmation. If they were to embrace financial health as an objective, financial service providers would design products aimed at supporting the elements of financial health and would become engaged with customers as partners in their pursuit. We offer here a few thoughts on how to promote financial health through financial service provision. While people can use many financial services to improve their financial health, some products or product features contribute more directly than others.

Selecting and Sustaining Customers

Among the reasons account-retention zealots have gained traction is the squishy nature of retention costs, to begin with. While capture costs are often tracked to the penny, retention costs often pass under the radar, parsed far and wide in General Ledger, into accounts called Product Development, Customer Support, Product Returns, and Allowances. Little wonder that the disparity between capture costs and retention costs appears massive. As Boeing’s executives know well, it takes just a cataclysmic event or two to upend the capture-retention math. On November 13, 2019, The Wall Street Journal reported that Boeing “has set aside an initial $6.1 billion that it expects to pay over the next several years in the form of cash, discounts, and services” to compensate customers affected by the 737 MAX grounding. Investing in customer retention makes sense when the objective is keeping the right customer and not keeping any customer. You probably heard it correctly the first time. A new mindset might also involve a more holistic view of product offerings. Initially, many FinTech start-ups focus on a single product. A customer perspective would recognize how deeply interconnected financial decisions are and would seek to offer a broader range of services, thus creating deeper customer relationships. We are starting to see a welcome shift among some of the more established FinTechs, such as Lydia and Zoona, which began with a single product and are now working to evolve a broader, more supportive product suite. Partnerships with various providers, such as those established by Dvara for its rural channels program, are another route to such an offering, which may be especially important for products like insurance and pensions. With a new mindset, providers would also support their customers to build their financial capability – the knowledge, skills, and behaviors needed to manage their financial lives well. They would provide more support for new customers to use their products well and would assist them in achieving their financial lives and planning for their goals.